There are many young people debating whether they should renew the lease on their apartment or sign a contract to purchase their first home. As we have said before, mortgage interest rates are still near historic lows and rents continue to rise.

Housing Cost & Net Worth

Whether you rent or buy, you have a monthly housing cost.

As a buyer, you are contributing to YOUR net worth.

Every mortgage payment is a form of what Harvard University’s Joint Center for Housing Studies calls “forced savings.”

“Since many people have trouble saving and have to make a housing payment one way or the other, owning a home can overcome people’s tendency to defer savings to another day.”

The principal portion of your mortgage payment helps build your net worth through building the equity you have in your home.

As a renter, you are contributing to YOUR LANDLORD’S net worth.

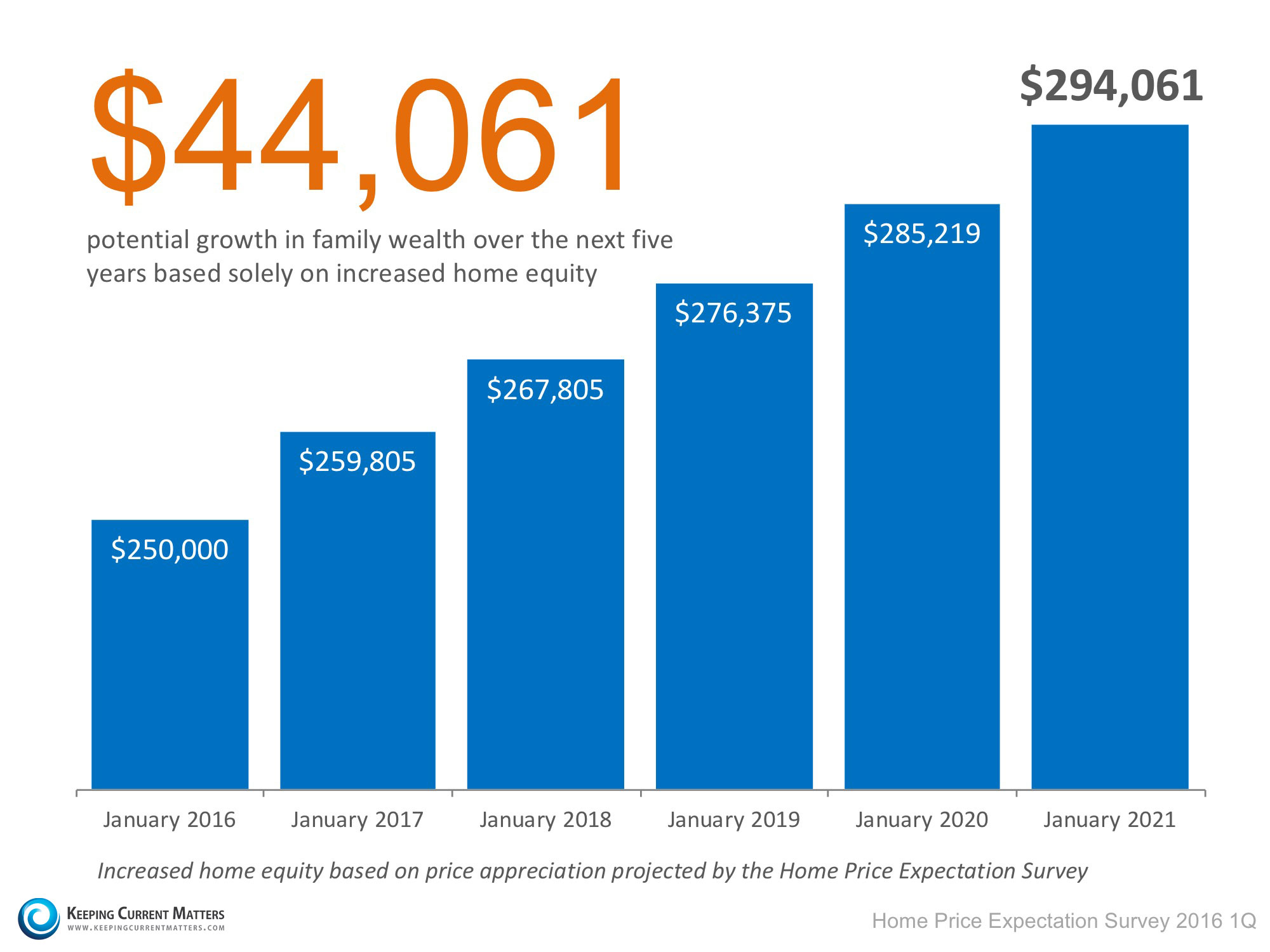

Below is an example of the home equity that would be accrued over the course of the next five years if you had purchased a home in January; based on the results of theHome Price Expectation Survey.

In this example, simply by paying your mortgage, you would have increased your net worth by over $44,000!

Bottom Line

Use your monthly housing cost to your advantage! Meet with a local real estate professional who can explain the opportunities available in your market.