In their latest Housing Market Insight & Outlook report, Freddie Mac revealed that recent low down payment initiatives have raised concerns that we may be returning to the same lax mortgage qualifications that caused the housing crisis from which we are just now recovering.

The report went on to explain that today’s underwriting guidelines are nothing like those that existed just prior to the housing meltdown.

“Pre-crisis underwriting allowed layered risk, that is, the combination of multiple features that amplified credit risk. Low down payments often were combined with variable-payment loan structures, property-based underwriting, and questionable appraisals. These risk factors, along with the ‘irrational exuberance’ of some borrowers, led to large losses during the crisis.”

What is layered risk?

In the pre-crisis environment, many mortgage loans incorporated several additional features besides low down payments that multiplied the total risk of the loans such as: variable payment options, underwriting based on the property not the borrower, questionable appraisal processes. Borrower expectations were also overly optimistic at that time.

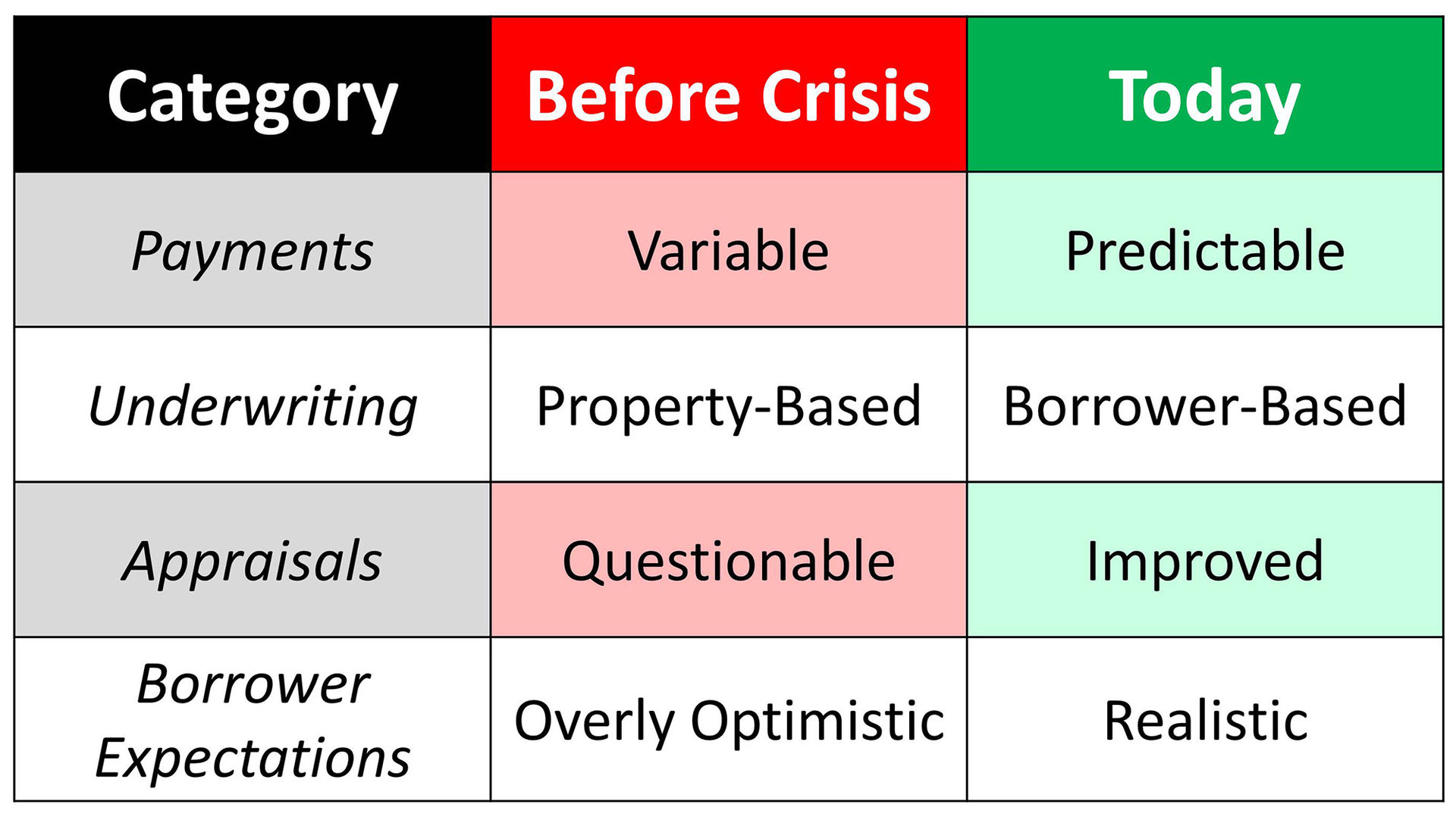

Freddie Mac highlights the difference between then and now by using a table in the report:

By removing the “layered risk”, we can be confident that low down payment programs will not impact the market the way mortgage underwriting impacted the market a decade ago. And the report explains:

“Previous research has found that reduced down payments can increase the relative probability of homeownership among some groups by over 25 percent.”

Bottom Line

We believe the report’s conclusion says it all:

“As long as the underwriting process bars the return of the layered risks prevalent in the pre-crisis era, lower down payments are not a cause for concern.”