Recently, Freddie Mac published a blog post titled Mortgage Rates: Still the Deal of the Century. They explained that, if you are planning to purchase a home, now may be the time:

“If you are in the market to buy a home, today’s average mortgage rates are something to celebrate compared to almost any year since 1971.”

And they let their readers know that there is no guarantee that rates will remain this low:

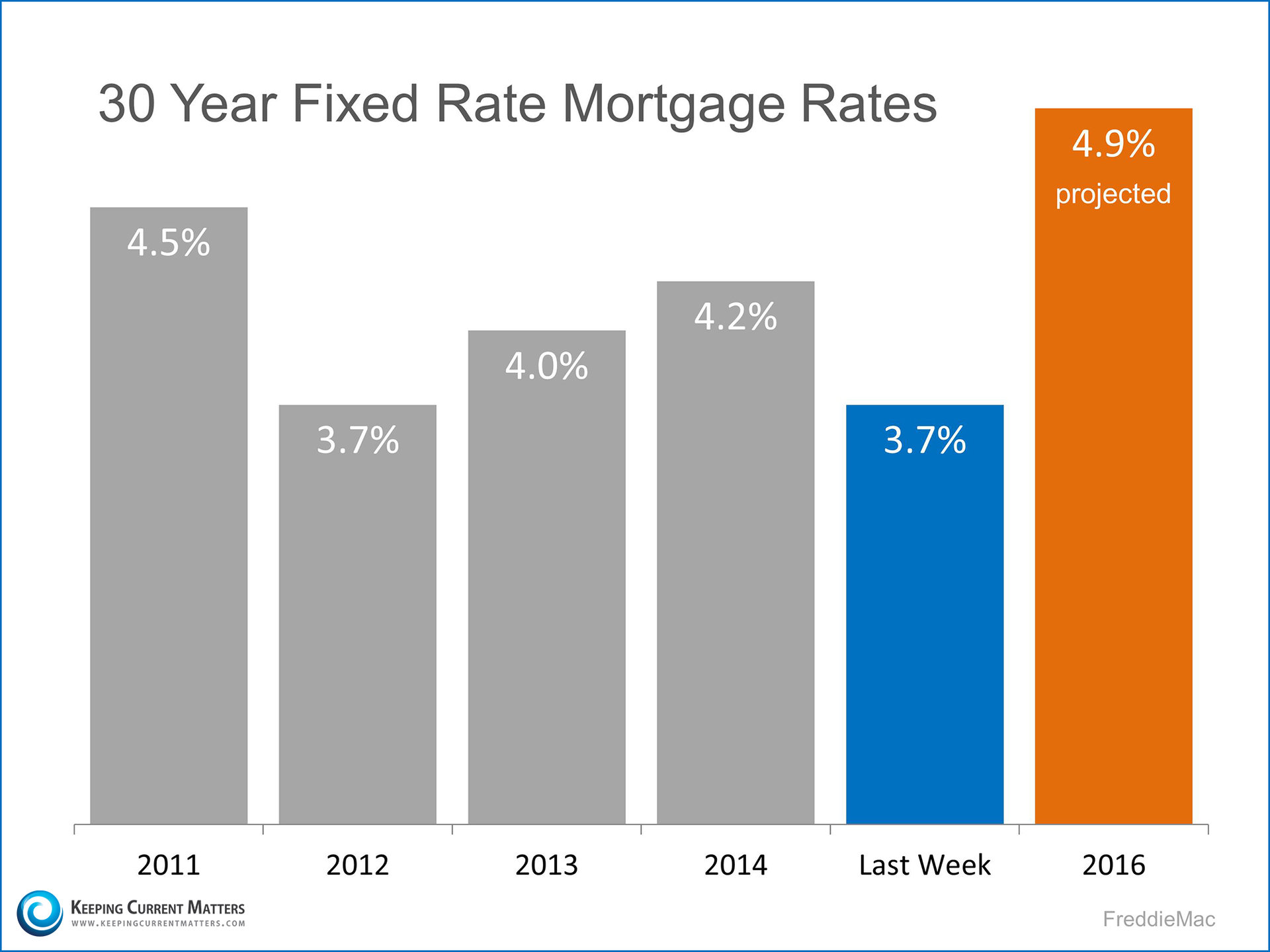

“Over the past few years, we’ve enjoyed a long run of historically low mortgage rates. While no one expects them to change dramatically overnight, they are expected to head up. Most experts agree that mortgage rates will drift up in the coming months to end the year approaching 4.50%…Buying a home is a big investment – perhaps the biggest one you’ll make in your life. So, it’s important to be sure you are ready to make that purchase. If you are ready, today’s rates are not to be missed.”

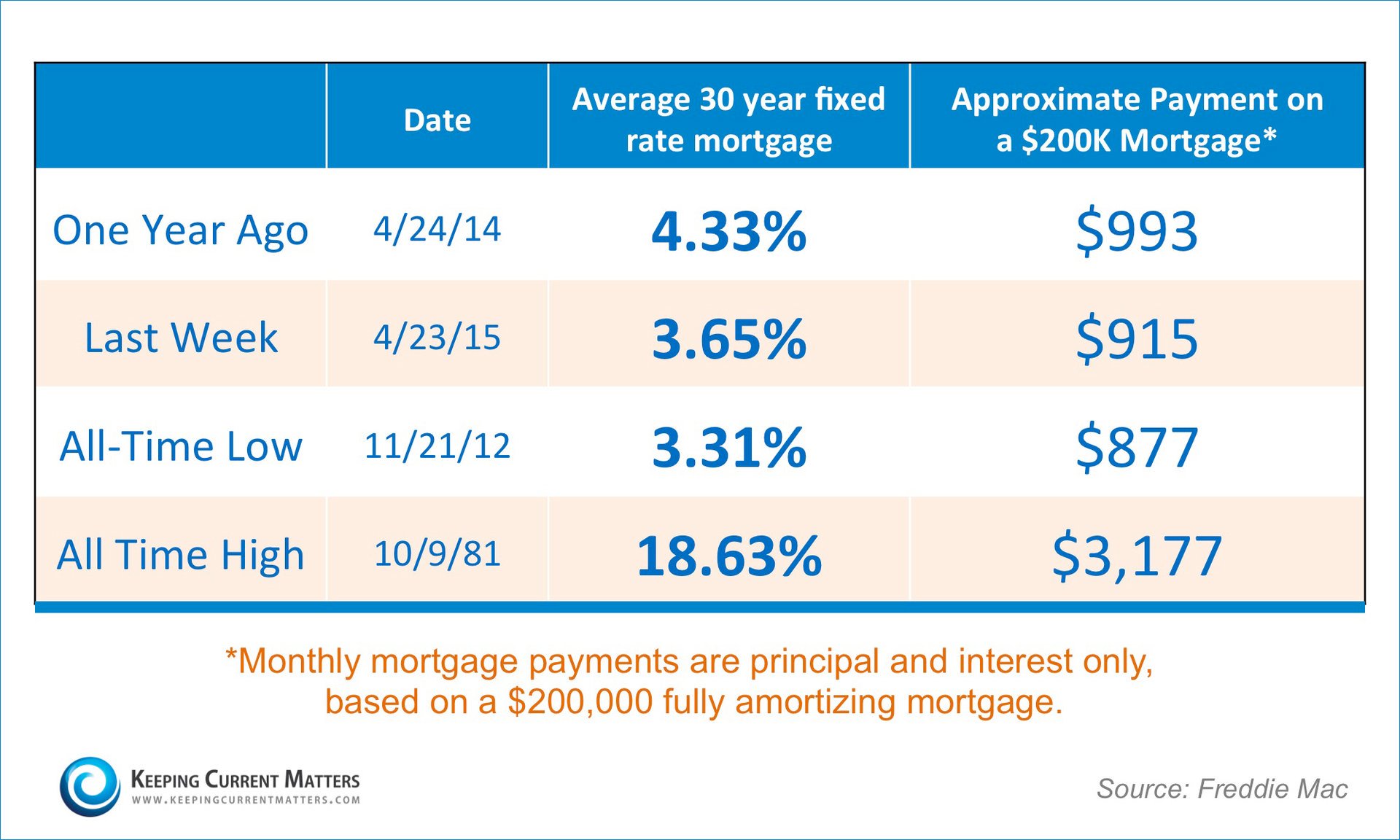

The article went on to calculate what the principal and interest payment would be based on a $200,000 fully amortizing mortgage at different times in history.

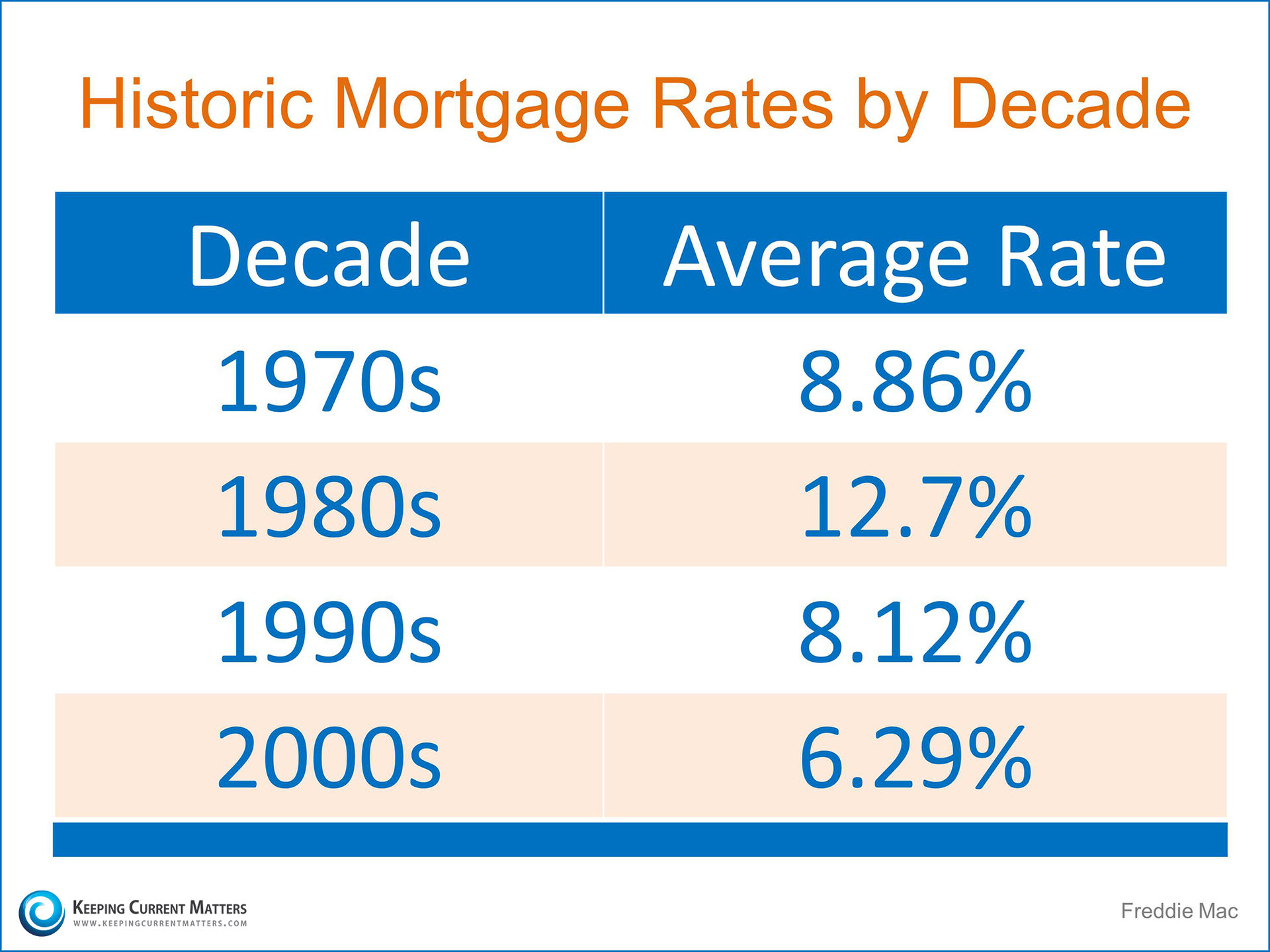

Here is a look at rates over the decades:

Here is a look at rates over the last four years and what Freddie Mac projects for next year:

Bottom Line

If you are thinking of buying your first home or looking to move up to your dream home, now may be the time to do it.