There are many benefits to homeownership, one of top ones, is being able to protect yourself from rising rents and lock in your housing cost for the life of your mortgage.

The National Association of Realtors (NAR) just released their findings of a study in which they studied “income growth, housing costs and changes in the share of renter and owner-occupied households over the past five years in metropolitan statistical areas throughout the US.”

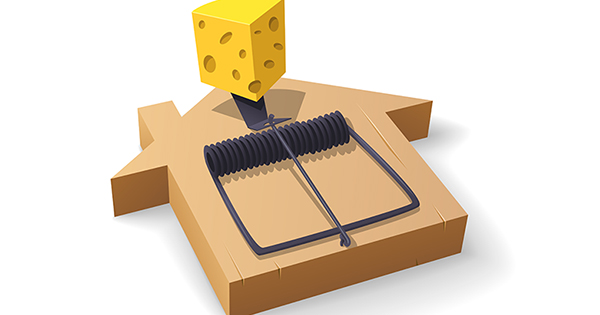

Don’t Become Trapped

The study revealed that over the last five years, a typical rent rose 15%, while the income of renters grew by only 11%. If you are currently renting, this disparity in growth could get you caught up in a cycle where increasing rents continue to make it impossible for you to save for a necessary down payment.

The top 5 markets where renters have seen the highest increase in rents since 2009 are:

- New York, NY (50.7%)

- Seattle, WA (32.4%)

- San Jose, CA (25.6%)

- Denver, CO (24.1%)

- St. Louis, MO (22.3%)

Homebuyers, who were able to purchase their home over the same five-year period and lock in their housing costs, were able to grow their net worth as home values have increased and their mortgage balances have gone down.

Know Your Options

Perhaps you have already saved enough to buy your first home. HousingWirereported that analysts at Nomura believe:

“It’s not that Millennials and other potential homebuyers aren’t qualified in terms of their credit scores or in how much they have saved for their down payment.

It’s that they think they’re not qualified or they think that they don’t have a big enough down payment.” (emphasis added)

According to Freddie Mac:

“Depending on their credit history and other factors, many borrowers can expect to make a down payment of about 5 to 10%. And new 3% down financing options for qualified borrowers could mean a down payment as little as $6,000 for a $200,000 home.”

Bottom Line

Don’t get caught in the trap so many renters are currently in. If you are ready and willing to buy a home, find out if you are able. Have a professional help you determine if you are eligible to get a mortgage.