As a seller, you will be most concerned about ‘short term price’ – where home values are headed over the next six months. As either a first time or repeat buyer, you must not be concerned only about price but also about the ‘long term cost’ of the home.

Let us explain.

There are many factors that influence the ‘cost’ of a home. Two of the major ones are the home’s appreciation over time, and the interest rate at which a buyer can borrow the funds necessary to purchase their home. The rate at which these two factors can change is often referred to as “The Cost of Waiting”.

What will happen in 2015?

A nationwide panel of over one hundred economists, real estate experts and investment & market strategists project that home values will appreciate by almost 4% by the end of 2015.

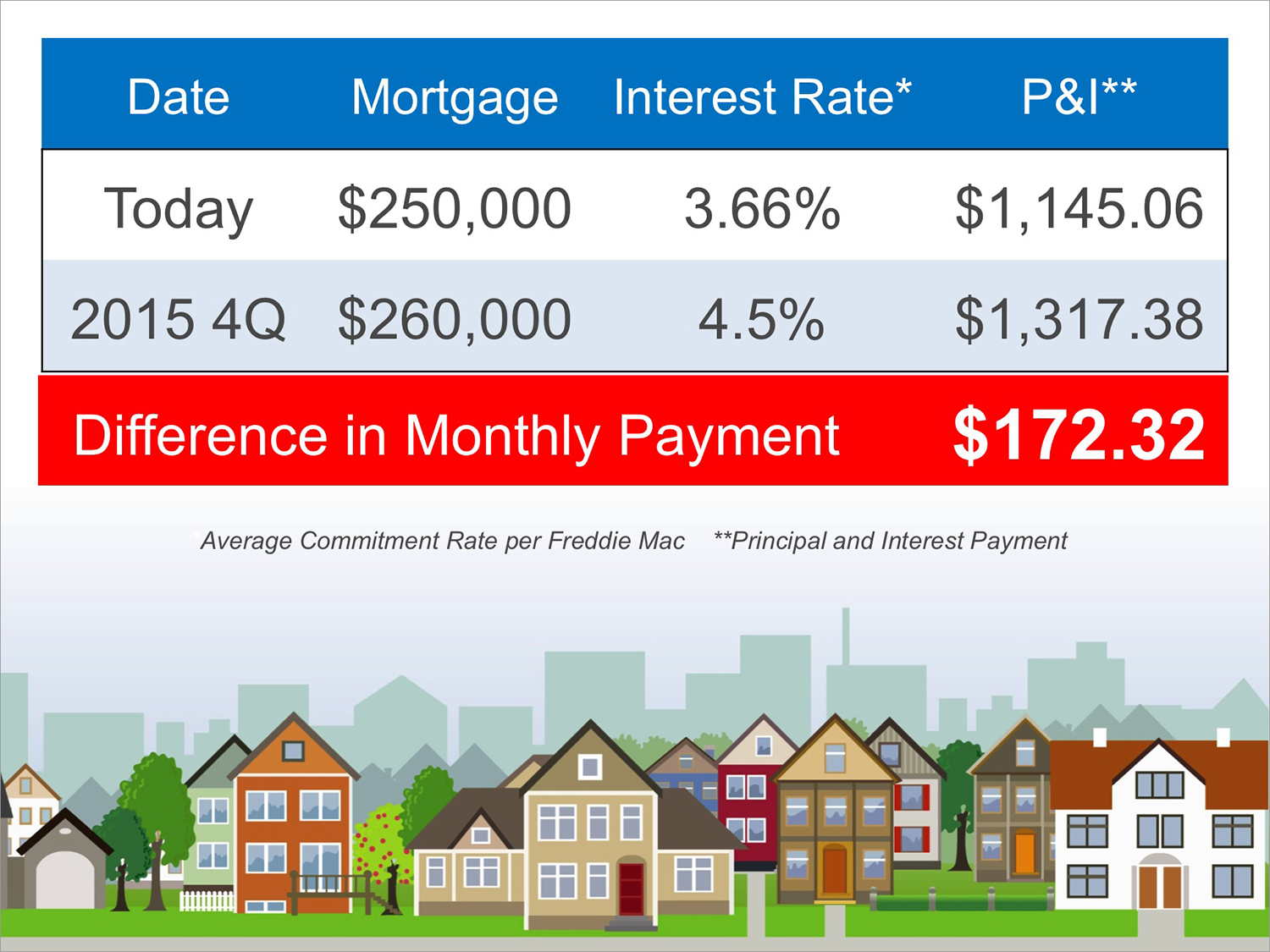

Additionally, Freddie Mac’s most recent Economic Commentary & Projections Table predicts that the 30-year fixed mortgage rate will appreciate to 4.5% by the end of 2015.

What Does This Mean to a Buyer?

Here is a simple demonstration of what impact these projected changes would have on the mortgage payment of a home selling for approximately $250,000 today: